florida estate tax rates 2021

The Florida corporate incomefranchise tax rate is reduced from 55 to 4458 for taxable years beginning on or after January 1 2019 but before January 1 2022. Osceola County collects on average 095 of a propertys.

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

Floridas average real property tax rate is 098 which is slightly lower than the US.

. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005. The median property tax in Broward County Florida is 2664 per year for a home worth the median value of 247500. The exemption amount will rise to 51 million in 2020 71 million in.

There is also an average of 105 percent local tax added onto transactions giving the state its 705. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. Florida Estate Tax Guide Updated for 2021 Paul Sundin CPA.

Broward County collects on average 108 of a propertys. Lucie County Florida is 2198 per year for a home worth the median value of 177200. What Is The Florida Property Tax Rate.

March 30 2022. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Floating Rate of Interest Remains at 7 Percent for the Period January 1 2022 Through June 30 2022.

The median property tax in Martin County Florida is 2315 per year for a home worth the median value of 254900. The median property tax in St. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

Further reduction in the tax. Lucie County collects on average 124 of a propertys. Florida has a sales tax rate of 6 percent.

Martin County collects on average 091 of a propertys assessed fair. Tax Valuation and Income Limitation Rates. The average Florida homeowner.

Counties in Florida collect an average of 097 of a propertys assesed fair. Florida real property tax rates are implemented in. According to section 193155 FS property appraisers must assess.

As long as your Florida estate tax payment exceeds the amount of your other states tax you. Florida Property Tax Rates. Floridas general state sales tax rate is 6 with the following exceptions.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Property taxes in Florida are implemented in millage rates. The documents below provide Florida property tax statistical information.

The current federal tax exemptions are at 117 million in 2021. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in. Florida estate planning lawyers help people develop a family or business-friendly strategy to maximize tax savings tax cuts.

69 rows The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties.

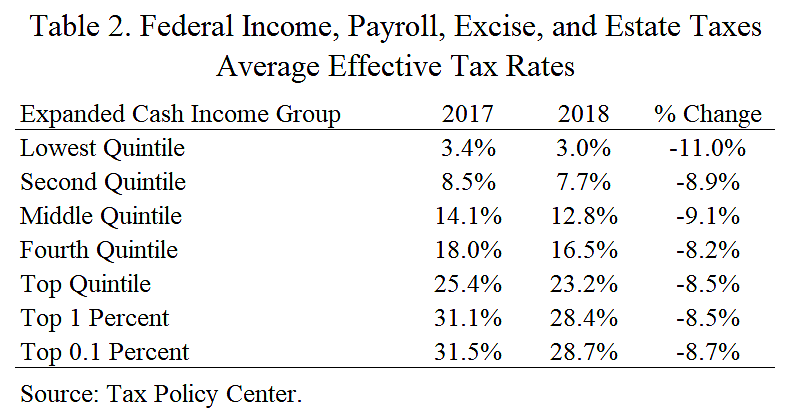

Individual Income Taxes Urban Institute

2021 2022 Gift Tax Rate What It Is And How It Works Bankrate

Property Taxes By State How High Are Property Taxes In Your State

Estate Tax In The United States Wikipedia

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

9 States With No Income Tax Kiplinger

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

2022 Income Tax Brackets And The New Ideal Income

Tax Rates By Income Level Cato At Liberty Blog

What Is The U S Estate Tax Rate Asena Advisors

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

How Many People Pay The Estate Tax Tax Policy Center

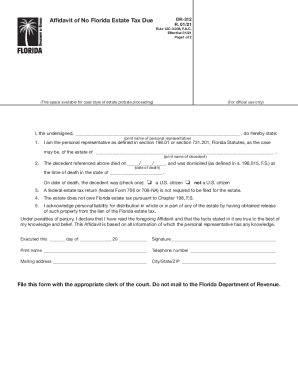

Get And Sign Pdf Affidavit Of No Florida Estate Tax Due Florida Department Of Revenue 2021 2022 Form

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Florida Estate Tax Everything You Need To Know Smartasset

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

18 States With Scary Death Taxes Kiplinger

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy